falling secondary market prices...

while not saying all watch prices are falling in this current market, (which isn't true, have u seen the huge amounts of $$$ the rare/super rare Pateks are going for at auction during these times!!??! gravity defying stuff...) in general, many watches in the sub us$50k range are dropping in price based on my view of the secondary market.

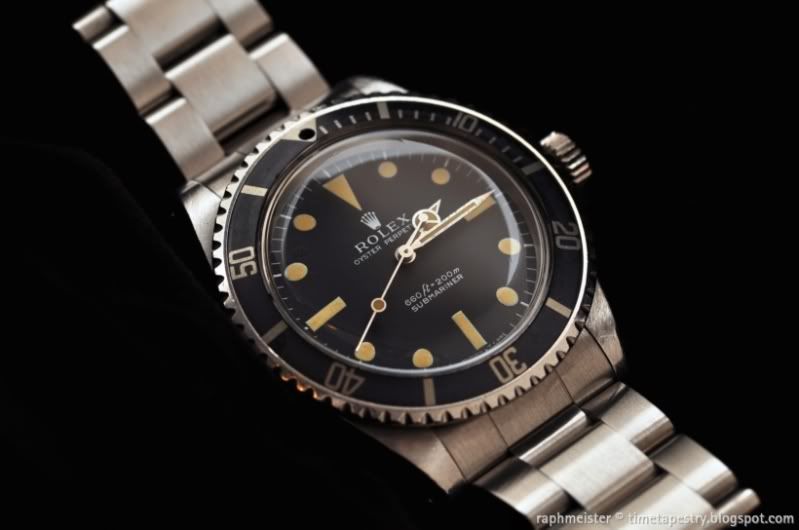

surprisingly, Rolex, which is many a times touted to be as good as currency, is taking a big hit with some pieces falling from premiums to list to discounts on list, which is a lot of change. an example would be the milgauss gv which i once owned... why is this so?

markets came a tumblin down

of course everyone knows of the sub-prime crises and the ensuing financial meltdown resulting in big names dissapearing and some losing their former lustre. but other than financial markets, the luxury watch market took a big hit as well. supply is increasing and demand and buying sentiment in general has fallen for most. some watches that were easier to move in the past sat in shelves and counters or in owners watchboxes as they tried to get sold but there were few takers and many bargain hunters low-balling on prices... (a lowballer in case u didn't know is someone who asks to buy your watch at 10k when you have advertised it for 15k. they are totally not worth wasting your time to reply in an email. but many try their luck of course :)

as the stock markets seem to have such a huge impact on watch prices, as and when there are bear market rallies or even some signs of hope of recovery, people seem to flock back and buy the pieces that they have been eyeing awhile. made a little money on the capital markets and rewarding themselves with a fine timepiece. nice ;)

so what to make of all of this? and whats the right way about it?

the thing is, unless the watch is worn by some super duper dude or lady, or its some super complicated or super rare Patek, don't be looking to acquire fine timepieces as investments. don't set the expectation that the price on a piece you acquire is gonna go up and you won't get dissapointed.

buy the watch coz u love the watch... because it speaks to you... it sings to you... and you can't put it back in its case, u want it on your wrist. you enjoy its beauty, its concept, the integrity of the watch maker or house selling it. the art of it all... everyone has different tastes and motivations for their purchases and the good thing is that there is a huge variety out there to satisfy most.

- cash is king in these times so store up your bullets i.e. cash, for special targets and wait for them to pop up at good prices.

- don't impulse buy (if u still are doing so) spend just that bit more time researching, experiencing the piece and consider your purchase more (especially bigger ticket items).. go for fewer but more quality pieces.

- some watches are art and as with art prices... if they are exceptional or exclusive pieces, and the integrity of the artists'/houses' work stands strong, then prices should hopefully not dip too much. but there is no guarantee... a watch is worth how much one is willing to pay for it...

buying what you love should not be a losing proposition of course and i hope what advice i have is of help towards that end. enjoy your watches in good health :) cheers, raph

No comments:

Post a Comment